8 best US regulated forex brokers in 2024

This is paid content. It was written and produced by Forex.

U.S. forex traders should only use a broker who adheres to regulatory compliance requirements. These are set by the Commodity Futures Trading Commission, or CFTC, and the National Futures Association, or NFA.

Our research and analysis found these to be the best forex brokers for U.S. traders:

- OANDA - Best US Forex broker overall

- Forex.com - Lowest spread Forex broker

- IG - Best Forex broker for beginner traders

- Interactive Brokers - Best Broker commission rates

- TD Ameritrade - Best U.S.-Based customer support

- eToro - Best social and copy trading platform

- Trading.com - Good selection of currency pairs

- Plus500 - Best Broker for Future Trading

1. OANDA - Best US forex broker overall

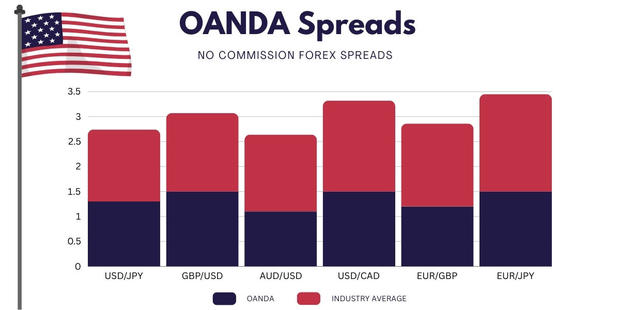

OANDA secures the top position as the premier U.S.-regulated forex broker by offering spreads that are consistently lower than the industry average. When combining this with their selection of elite trading platforms, tools and extensive loyalty program for traders with high volumes, we had to place them at the forefront.

Tight spreads with no commission fees

During our comprehensive analysis of the world's 40 top forex brokers, we found that OANDA's standard account spreads are typically 18.5% less than the industry average.

While the typical industry spread for AUD/USD is 1.54 pips, OANDA's minimum spread is just 1.1 pips, slashing the cost by over 28%.

Across all major currency pairs, OANDA consistently maintains lower spreads, often more than halving the industry's typical costs.

| Forex Broker | USD/JPY | GBP/USD | AUD/USD | USD/CAD | EUR/GBP | EUR/JPY |

|---|---|---|---|---|---|---|

| OANDA minimum spread | 1.3 | 1.5 | 1.1 | 1.5 | 1.2 | 1.5 |

| Industry average spread | 1.44 | 1.57 | 1.54 | 1.82 | 1.66 | 1.95 |

Loyalty program for high volume traders

OANDA's Elite Trader program caters to the dedicated trader, with five tiers starting at a monthly volume of 10 million. High-volume traders are eligible for rebates of $5 to $17 per million traded, which can cut trading costs by as much as 34%.

The program rewards participants with additional benefits, including:

- Free VPS for enhanced execution

- Unlimited wire transfers without fees

- Direct access to a relationship manager for bespoke support

- Complimentary advanced charting tools like TradingView

- Earn interest on unused margins where your trading account balance exceeds $10,000

Trading tools and platforms

OANDA provides traders with two platform options: MetaTrader 4 (MT4) and OANDA Trade. Each platform offers a distinct selection of features to support your trading activities, regardless of your preferred strategy.

MetaTrader 4 features

MetaTrader 4, a platform favored by forex traders worldwide, offers comprehensive charting capabilities and an extensive range of in-built technical indicators. With access to nine timeframes and over 50 pre-installed indicators, traders can precisely analyze market trends and movements. The platform's user-friendly interface allows for trading directly from the charts, streamlining the process.

Justin Grossbard from CompareForexBrokers praises the core benefits of the MT4 platform, focusing on its capacity for automation.

"The standout feature of MetaTrader 4 is undoubtedly its Expert Advisors (EAs). This is the reason MT4 remains my go-to platform," he shares.

"Imagine having a tireless ally in your trading journey, one that executes trades and fine-tunes your strategies through meticulous backtesting. EAs are that ally, offering a relentless pursuit of efficiency and precision, turning complex data into clear, actionable decisions."

OANDA clients looking for a more sophisticated trading setup can opt for the MT4 Premium Upgrade, which includes 28 extra technical analysis tools to refine and automate trading tactics.

Additionally, the MT4 Orderbook Indicator, exclusive to OANDA, offers a 20 minute delay for all clients and five five-minute delay for elite traders' view of all OANDA clients' open orders and positions and integrates them directly into their MT4 charts. This indicator, which comes without additional charges for traders who meet certain deposit and trading volume thresholds, offers insightful data on market sentiment.

OANDA Trade and TradingView

OANDA Trade, the broker's own platform, comes enhanced with a TradingView's suite of over 65 technical indicators and extensive drawing tools for comprehensive analysis.

The user-friendly platform streamlines your trading with Autochartist's automated chart pattern recognition, ensuring you're well-equipped for technical analysis. It also keeps you connected to the pulse of global finance with its Economic Overlay, delivering real-time economic updates within the platform.

OANDA Trade also includes the option to integrate specialist third-party tools. For those looking to fine-tune their strategies, Motivewave's advanced backtesting capabilities are invaluable, while Dow Jones FX Select provides a steady stream of news and expert analysis to guide your trading decisions.

Financial markets

OANDA offers a range of over 68 forex pairs, including major, minor, and exotic currencies. If you are interested in spot cryptocurrency trading, OANDA has partnered with Paxos to allow account holders access to trade key cryptos like Bitcoin, Ethereum, and Litecoin on Paxos's itBitexchange through the OANDA app.

Account management

One of the key advantages of trading with OANDA is that they do not have a minimum deposit requirement, which means you can start trading with any amount that suits your budget. For deposits and withdrawals from your trading account, this broker supports a range of payment methods including debit cards (Visa and Mastercard), ACH bank transfers and wire transfers.

OANDA final verdict

- Offers spreads significantly lower than the industry average

- No commission fee pricing structure for standard accounts

- Tiered loyalty program with benefits like free VPS, unlimited wire transfers and direct access to a relationship manager

- Current Welcome Bonus offer of up to $10,000 which expires January 31, 2024

2. Forex.com - lowest spread forex broker

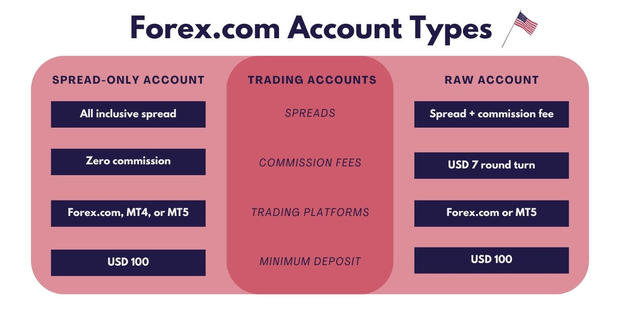

Forex.com is second on our list as it is a popular broker for those wanting an ECN-style account type in the United States. Its RAW Account features ECN-style pricing with the potential for spreads to reach as low as zero pips, plus a fixed commission fee.

As well as tight spreads, U.S. traders benefit from a broad selection of trading products. You'll have access to forex, shares, precious metals and various derivatives like futures and options. It's an attractive combination of expansive financial market access and competitive pricing.

ECN-style spreads

Traders at Forex.com can select from two pricing options to suit their trading strategy. The spread-only standard account does away with commission fees, which benefits beginner traders who prefer a simple cost structure. This account type is compatible with MetaTrader 4, MetaTrader 5, and the Forex.com platform, offering versatility in your trading platform choice.

The RAW Account, on the other hand, is designed for traders aiming for the tightest spreads, starting at zero pips, with a fixed commission fee of $7 round turn. This account is available on the Forex.com platform and MetaTrader 5 for an experience tailored to high-volume trading.

Funding your Forex.com account is straightforward and flexible. Payment methods include bank transfers (ACH), Mastercard and Visa debit cards or wire transfers. To start trading, a low minimum deposit of just $100 is required for both account types.

Active trader rebates

Forex.com's Active Trader Program is designed to support and reward high-volume traders. The program scales up the cash rebates as the monthly trading volume increases, potentially slashing trading costs by up to 15%. For traders who hit the threshold of $1 million in monthly trading volume, the program offers rebates that can amount to as much as $10.

Additionally, the program includes the services of a personal relationship manager, daily interest margin and waived wire transfer fees, all contributing to a more cost-effective and personalized trading experience.

Trading platforms and tools

Forex.com offers a selection of trading platforms - including their own proprietary platform - alongside the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Forex.com WebTrader and mobile apps

The broker's proprietary platform is accessible via web browsers and dedicated mobile apps for both Android and iOS devices. Enhanced with TradingView's comprehensive suite of over 80 technical indicators, 50 drawing tools, 14 timeframes and multiple chart types, the platform enables the development of sophisticated trading strategies through an intuitive interface.

MetaTrader 4 and MetaTrader 5

At Forex.com, traders can access the full suite of standard MetaTrader tools on MT4 and MT5, complemented by extra features. This includes nine in-built Expert Advisors for automated trading strategies alongside 15 unique indicators.

Additional tools

For those seeking efficiency in identifying trading opportunities, Trading Central is a valuable resource. Forex.com also provides SMART Signals and Capitalise.ai for automated strategy creation, NinjaTrader for advanced charting and trading management and API trading for those who prefer to build and execute custom strategies.

Forex.com final verdict

- ECN-style RAW Account with potential for spreads as low as zero pips

- Active Trader Program offering cash rebates and a personal relationship manager

- Access to MetaTrader 4, MetaTrader 5, and proprietary platforms with additional trading tools

3. IG - best forex broker for beginner traders

IG is an ideal choice for beginner traders in the forex market thanks to their commitment to providing an accessible and educational trading environment. From user-friendly platforms to extensive learning resources, we found that IG tailors its services perfectly to ensure new traders can navigate the forex landscape with confidence and ease.

Education and resources

For beginner traders, IG's educational materials are invaluable. The IG Academy presents a comprehensive suite of online resources, including live training sessions and tutorials, essential for mastering the fundamentals of forex trading.

The broker further enhances learning through interactive seminars and webinars, which delve deeper into trading concepts. A glossary and educational materials are available, clarifying trading terminology and simplifying complex ideas. Additionally, IG provides a free economic calendar and analytical tools, fostering the practical application of theoretical knowledge.

To complement the broker's various educational resources, IG grants access to a demo account with $20,000 in virtual funds for training purposes. This feature allows beginners to safely navigate the real-world forex market, gaining trading experience without the high risk of losing real money.

Reputation

IG's reputation in the forex trading community is solid, evident by its 'great' rating on TrustPilot, backed by thousands of five-star reviews. This broker has established a strong presence in the foreign exchange industry and has been operating for over 45 years, serving over 313,000 clients globally.

The broker's commitment to innovation and user experience, particularly in mobile trading, has not gone unnoticed in the FinTech sector. They have been awarded numerous accolades for their brokerage services and technology. We asked industry expert Noam Korbl from CompareForexBrokers.com to shed light on these achievements.

He commented, "IG's track record in the financial services industry is remarkable, and they have been recognized for their brokerage excellence and technological advancements in the industry many times this year. Their mobile trading app, in particular, stands out, having received multiple awards for its user-friendly interface and comprehensive features. This recognition is a testament to IG's ongoing commitment to providing top-tier trading experiences for their clients."

Forex trading platforms

IG caters to beginner forex traders with two primary platform choices: their bespoke proprietary platform and MetaTrader 4 (MT4). The proprietary platform is particularly suited for newcomers, offering a user-friendly interface that eases the new user into the trading process. This platform is accessible across various devices, including web, tablet and mobile apps, ensuring compatibility with both Android and iOS systems.

For those beginners who envisage progressing into a more sophisticated trading platform, IG also provides MT4. This platform is celebrated for its advanced features, such as Expert Advisors (EAs) for automated trading and AutoChartist for advanced chart analysis. This makes MT4 a valuable option for traders as they evolve in their forex trading journey.

IG final verdict

- Streamlined platforms for easy forex trading initiation

- Extensive resources for learning and strategy development

- Proven track record with accolades for user experience and technology

4. Interactive Brokers - best broker commission rates

Interactive Brokers (IB), which is widely acclaimed for its commitment to low fees, is an attractive choice for traders who value cost efficiency alongside powerful trading tools.

Low trading fees

IB's commitment to keeping fees low is evident in its pricing structure. With direct access to interbank quotes and top-tier liquidity providers, clients benefit from transparent pricing with no hidden spreads or markups. When U.S. clients are forex trading with IB, they enjoy tight spreads with volume-tiered pricing.

If you're interested in share trading, this online broker offers two main account options for retail traders. The IBKR Lite account is ideal for beginners with no commissions on U.S.-listed stocks and ETFs. The IBKR Pro account, on the other hand, offers competitive tiered pricing for active traders.

IB's other financial instruments also feature competitive rates. Options start at $0.15 to $0.65 per contract, futures as low as $0.25 per contract and mutual funds transactions at a maximum of $14.95.

Trading platform options

Interactive Brokers offers a selection of trading platforms to suit various trading preferences and expertise levels:

- IBKR Trader Workstation (TWS): A comprehensive platform for intermediate to advanced traders, offering trading across multiple financial markets

- IBKR Desktop: A streamlined desktop platform ideal for beginner to intermediate traders, with a user-friendly interface

- IBKR Mobile: A mobile trading platform for traders who need on-demand access to global markets and tools

- IBKR GlobalTrader: An app designed for beginners that allows you to trade stocks, ETFs, options, and crypto

- IBKR Client Portal: A web-based platform for easy account management and trading, suitable for all levels of traders

If you are a full-time trader using custom automated trading systems, Interactive Brokers also provides additional API options. The IBKR IMPACT app caters to those interested in ESG-focused investing.

Charting tools available

The Trader Workstation offers advanced charting tools and functionality for experienced traders. TWS allows for comprehensive market analysis, strategy testing and trade execution across more than 150 financial markets worldwide. The platform is highly customizable and available across multiple interfaces, including desktop, web and mobile apps.

Interactive Brokers final verdict

- Low trading fees with direct access to interbank quotes

- Multiple platform options including TWS for advanced traders and IBKR Lite for beginners

- Advanced charting tools available on Trader Workstation

5. TD Ameritrade - best U.S.-based customer support

TD Ameritrade sets the gold standard in customer support for U.S. traders, offering an unparalleled service experience delivered by industry experts.

Following its acquisition by Charles Schwab, TD Ameritrade has further enhanced its features for all American clients. The collaboration unlocked access to the acclaimed "thinkorswim" trading platform, expanding the online broker's library of educational resources and increasing the level of specialized support available to traders.

Customer service for U.S. traders

When it comes to support, TD Ameritrade offers industry-leading response times and knowledgeable assistance. As a U.S. client, you gain access to a support desk filled with former floor traders who understand the nuances of the market, available around the clock.

Whether it's a question about a trade, a request for strategy optimization or guidance on platform features, the team is ready to assist with expert advice.

Customer support methods

TD Ameritrade's customer support is accessible 24/7 through a variety of channels. You can reach out via live chat, engage with support teams on social media platforms like Facebook and Twitter, send a fax or make a phone call.

Catering to a diverse clientele, TD Ameritrade also offers multilingual customer support, including services in Spanish and Mandarin. For those who prefer in-person interactions, you can visit one of TD Ameritrade's 175 branches across the U.S. during office hours.

Trading accounts

TD Ameritrade's trading account does not require a minimum deposit, making adding or withdrawing funds straightforward with no extra fees. Variable spreads start at 1.0 pip - in line with industry averages - and you won't pay commissions.

One limitation? TD Ameritrade only supports one base currency - U.S. dollars.

"Thinkorswim" platform

The "thinkorswim" trading platform suite stands out for its advanced tools and technical analysis features. It caters to serious traders who require elite resources to perform in-depth research and test trading strategies.

The platform is available as downloadable software, a streamlined WebTrader platform and a mobile app optimized for iOS and Android devices. You can even trade from your Apple Watch if you're so inclined.

TD Ameritrade final verdict

- Acclaimed "thinkorswim" trading platform for in-depth research and strategy testing

- 24/7 customer support with industry-leading response times

6. eToro - best social and copy trading platform

eToro stands at the forefront of copy trading, offering a dynamic platform that empowers users to follow and copy the trades of seasoned investors.

Copy trading

At the core of eToro's innovative platform is the CopyTrader system, which allows users to easily mirror selected traders' trading activities. Users can filter through traders and copy them based on risk level, asset class and other criteria, tailoring their copy trading experience.

For successful traders, eToro's Popular Investor Program offers the chance to earn additional income. As your strategy gains popularity and you acquire more followers, you can earn fixed payments and rank bonuses. An added benefit? These payments are real funds that can be withdrawn at any time.

ETF and stock investing

eToro is also an excellent platform for those looking to build a long-term investment portfolio with ETFs and stocks. The platform boasts 2,083 stocks and 269 ETFs, spanning various sectors such as indices, dividends, bonds and commodities.

Smart Portfolios on eToro provide a curated investment experience, bundling assets and markets according to a strategic theme. They're ideal for investors seeking a diversified portfolio who lack the time or interest for serious day trading.

Cryptocurrencies

For those interested in the crypto market, eToro has more than 24 cryptocurrencies, from the dominant players like Bitcoin and Ethereum to more obscure altcoins. This variety caters to different risk appetites and investment strategies, allowing users to diversify within the crypto space.

eToro final verdict

- Leader in copy trading with the innovative CopyTrader system

- Popular Investor Program to earn income for those with followers

7. Trading.com - good selection of currency pairs

Trading.com offers a specialized forex trading account tailored to U.S. clients with over 70 currency pairs, no commission fees and a low minimum deposit. This online broker may be your best bet if you intend to trade forex exclusively.

Currency trading

The T1 Account is the online broker's answer for dedicated forex traders. The account type gives you access to over 70 currency pairs with a standard account structure and no commission fees. The account also uses U.S. dollars as the base currency and has low minimum deposit requirements starting at $50.

Justin Grossbard of CompareForexBrokers.com explained the leverage options available for various forex pairs.

"Leverage is available in the U.S. and varies depending on the major, minor or exotic currency pair you are trading. For instance, if your trading strategy involves a major currency pair like EUR/USD, Trading.com will offer a maximum leverage of 50:1. If you are trading an exotic currency pair like the USD/TRY, your leverage will be limited to 4:1."

Trading platforms

Trading.com offers the choice of their proprietary platform or MetaTrader 5. The proprietary web trader platform and mobile app are streamlined ensuring easy trading no matter where you are.

If you prefer a more advanced trading environment, MetaTrader 5 provides a suite of sophisticated charting and research tools. The inclusion of a research portal, newsfeed, daily updates and an economic calendar means you have all the tools you need to develop complex forex trading strategies.

Trading.com final verdict

- Over 70 currency pairs available for trading with no commission fees

- Proprietary platform and MetaTrader 5 offered, catering to various trading experience levels

8. Plus500 - best broker for futures trading

Plus500 stands out in the futures trading landscape, offering an accessible entry point for beginners with a user-friendly interface and a comprehensive suite of micro and mini contracts.

Futures markets

The range of futures markets available on Plus500 is extensive, allowing traders to explore sectors such as forex, cryptocurrencies, agriculture, metals, interest rates, energy and equity index futures.

Plus500's minimum day trading margins are designed to be low and attractive, enabling traders to manage their investments effectively. For example, trading micro Bitcoin futures requires just $100 in margin, making it an accessible option for those looking to enter the crypto market.

Plus500 final verdict

- User-friendly interface ideal for beginners in futures trading

- Offers an extensive range of micro and mini contracts for futures trading

What are the best forex brokers in the USA?

Forex, the international currency market, facilitates round-the-clock currency exchange, enabling trading between different currencies at agreed prices. When it comes to forex trading accounts, brokers typically offer various types to suit different trading needs and experience levels.

Before getting started it helps to understand how Forex works and the legal parameters in the United States.

What Forex account types do brokers offer?

All eight of the regulated forex brokers listed offer a demo account. No funding is required to open this account type with the ability to trade virtual currency in a risk-free environment. We recommend anyone new to trading or planning to trade algorithmically to do their testing on a demo account before trading real money.

When opening a live account, it's important to note the minimum deposit requirements. This can range from $10 (eToro) to $2,000 (TD Ameritrade). All brokers regulated by the Commodity Futures Trading Commission (CFTC) have negative balance protection so you can't lose more than your deposit. That said, if you are new to trading, choosing a broker with a lower minimum deposit should be considered.

The final account type factor to consider is the leverage options for foreign exchange markets. While maximum leverage in the U.S. is set by the CFTC, there is still a large variation between brokers and accounts. Leverage increases exposure for a trader, but it also increases the risks, so higher margin levels are only recommended for more experienced traders.

Are Forex Brokers and Forex trading legal in the U.S.?

Yes, forex brokers are legal in the U.S., but they must be registered with and regulated by the Commodity Futures Trading Commission (CFTC) and be members of the National Futures Association (NFA). This ensures compliance with strict financial standards and offers protection to traders. Always verify a broker's regulatory status before trading to ensure you're protected under U.S. law.

Regulators in Australia (ASIC), New Zealand (FMA), Europe (MiFID-compliant authorities such as CySEC), and the UK (FCA) also enforce strict standards, although there are variations. In New Zealand, for example, traders have access to higher leverage. In Europe and the UK, recent regulations have tightened leverage and margin requirements, moving closer to U.S. standards, particularly post-Brexit for the UK.

Forex trading regulations in countries like Mexico, Colombia, and Chile are less stringent than in major financial jurisdictions. U.S. residents should be cautious and generally avoid brokerages regulated solely in these regions, due to frequent scams and potentially lower levels of trader protection.

What are the best trading platforms for U.S. Forex traders?

When choosing an online trading platform, U.S. forex traders should consider three key factors: The user interface and functionality, technical tools, such as indicators and charting tools, and accessibility, including mobile trading apps.

1. MetaTrader 4

MetaTrader 4 (MT4) is the most popular forex trading platform worldwide among retail investors. Its strength lies in its user-friendly interface and sophisticated mobile apps, which make trading accessible on the go. Furthermore, MT4 is widely recognized for its Expert Advisors (EAs), which enable traders to automate their trading strategies effectively.

2. MetaTrader 5

MetaTrader 5 (MT5) takes technical analysis a step further than its predecessor MT4 with its advanced indicators and enhanced charting tools. This platform is designed for traders who need more in-depth analysis and a broader range of technical tools to inform their trading decisions. MT5's sophisticated charting capabilities make it a preferred choice for traders looking for detailed market analysis.

3. TradingView

TradingView stands out for its superior user interface and exceptional charting capabilities, making it a top choice for traders who seek tools akin to those used by professional traders. Its intuitive design and advanced charting tools cater to traders who prioritize ease of use alongside comprehensive market analysis. This platform is particularly beneficial for those requiring detailed and accessible market insights to inform their trading strategies.

OANDA Disclaimer

OANDA Corporation is regulated by the CFTC/NFA. OANDA is a member Firm of the NFA (Member ID: 0325821). CFDs are not available to residents in the United States.

OANDA CORPORATION IS A MEMBER OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. OANDA Corporation is not party to any transactions in digital assets and does not custody digital assets on your behalf. All digital asset transactions occur on the Paxos Trust Company exchange. Any positions in digital assets are custodied solely with Paxos and held in an account in your name outside of OANDA Corporation. Digital assets held with Paxos are not protected by SIPC. Paxos is not an NFA member and is not subject to the NFA's regulatory oversight and examinations.

Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. You may lose more than you invest. Information on this website is general in nature. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Trading through an online platform carries additional risks.